Exam 2: Analyzing and Recording Transactions

Exam 1: Accounting in Business245 Questions

Exam 2: Analyzing and Recording Transactions201 Questions

Exam 3: Adjusting Accounts and Preparing Financial Statements227 Questions

Exam 4: Completing the Accounting Cycle177 Questions

Exam 5: Accounting for Merchandising Operations189 Questions

Exam 6: Inventories and Cost of Sales194 Questions

Exam 7: Accounting Information Systems166 Questions

Exam 8: Cash and Internal Controls195 Questions

Exam 9: Accounting for Receivables162 Questions

Exam 10: Long-Term Assets208 Questions

Exam 11: Current Liabilities and Payroll Accounting178 Questions

Exam 12: Accounting for Partnerships141 Questions

Exam 13: Accounting for Corporations210 Questions

Exam 14: Long-Term Liabilities158 Questions

Exam 15: Investments and International Operations156 Questions

Exam 16: Statement of Cash Flows173 Questions

Exam 17: Analysis of Financial Statements182 Questions

Exam 18: Managerial Accounting Concepts and Principles199 Questions

Exam 19: Job Order Cost Accounting165 Questions

Exam 20: Process Cost Accounting172 Questions

Exam 21: Cost Allocation and Performance Measurement173 Questions

Exam 22: Cost-Volume-Profit Analysis190 Questions

Exam 23: Master Budgets and Planning166 Questions

Exam 24: Flexible Budgets and Standard Costs178 Questions

Exam 25: Capital Budgeting and Managerial Decisions153 Questions

Select questions type

At the beginning of the current year, Taunton Company's total assets were $248,000 and its total liabilities were $175,000. During the year, the company reported total revenues of $93,000, total expenses of $76,000 and owner withdrawals of $5,000. There were no other changes in owner's capital during the year and total assets at the end of the year were $260,000. Taunton Company's debt ratio at the end of the current year is:

(Multiple Choice)

4.8/5  (38)

(38)

The balance sheet provides a link between beginning and ending income statements.

(True/False)

4.8/5  (43)

(43)

A _______________ is a list of all the accounts used by a company and their identification codes.

(Essay)

4.8/5  (32)

(32)

A transaction that decreases an asset account and increases a liability account must also affect one or more other accounts.

(True/False)

4.8/5  (32)

(32)

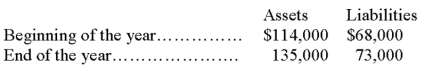

Josephine's Bakery had the following assets and liabilities at the beginning and end of the current year:

If Josephine made no investments in the business but withdrew $5,000 during the year, what was the amount of net income earned by Josephine's Bakery?

(Essay)

4.8/5  (40)

(40)

_____________________________ requires that each transaction affect, and be recorded in, at least two accounts. It also means that total amounts debited must equal total amounts credited for each transaction.

(Essay)

4.9/5  (34)

(34)

Zed Bennett opened an art gallery and as a dealer completed these transactions: Started the gallery, Artery, by investing $40,000 cash and equipment valued at $18,000.

2) Purchased $70 of office supplies on credit.

3) Paid $1,200 cash for the receptionist's salary.

4) Sold a painting for an artist and collected a $4,500 cash commission on the sale.

5) Completed an art appraisal and billed the client $200.

What was the balance of the cash account after these transactions were posted?

(Multiple Choice)

4.9/5  (32)

(32)

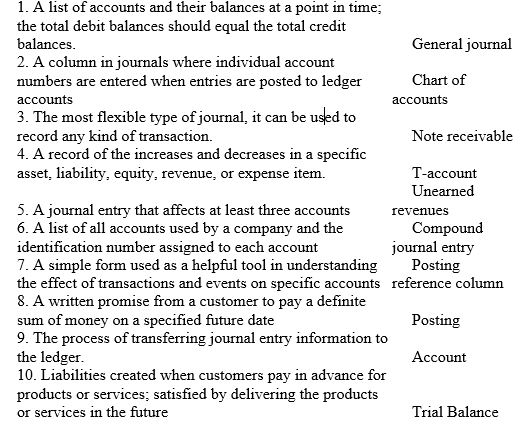

Match the following definitions and terms by placing the letter that identifies the best definition in the blank space next to the term.

(Essay)

4.9/5  (25)

(25)

When a company bills a customer for $600 for services rendered, the journal entry to record this transaction will include a $600 debit to Services Revenue.

(True/False)

4.7/5  (24)

(24)

Which financial statement reports an organization's financial position at a point in time?

(Multiple Choice)

4.9/5  (36)

(36)

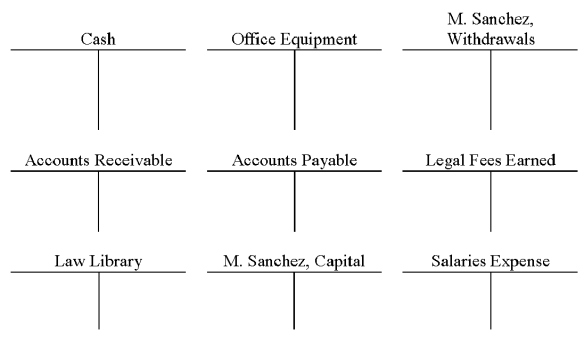

Maria Sanchez began business as Sanchez Law Firm on November 1. Record the following November transactions by making entries directly to the T-accounts provided. Then, prepare a trial balance, as of November 30.

a) Sanchez invested $15,000 cash and a law library valued at $6,000.

b) Purchased $7,500 of office equipment from Johnson Bros. on credit.

c) Completed legal work for a client and received $1,500 cash in full payment.

d) Paid Johnson Bros. $3,500 cash in partial settlement of the amount owed.

e) Completed $4,000 of legal work for a client on credit.

f) Sanchez withdrew $2,000 cash for personal use.

g) Received $2,500 cash as partial payment for the legal work completed for the client in (e).

h) Paid $2,500 cash for the legal secretary's salary.

(Essay)

4.8/5  (37)

(37)

The journal is known as the book of final entry because financial statements are prepared from it.

(True/False)

4.8/5  (40)

(40)

Revenues and expenses are two categories of ____________________ accounts.

(Essay)

5.0/5  (38)

(38)

Unearned revenue is classified as _______________ that is satisfied by delivering products or services in the future.

(Essay)

4.8/5  (37)

(37)

On September 30, the Cash account of Value Company had a normal balance of $5,000. During September, the account was debited for a total of $12,200 and credited for a total of $11,500. What was the balance in the Cash account at the beginning of September?

(Multiple Choice)

4.9/5  (35)

(35)

A company had the following accounts and balances year-end: If all of the accounts have normal balances, what are the totals for the trial balance?

(Multiple Choice)

4.8/5  (34)

(34)

Showing 121 - 140 of 201

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)