Exam 2: Analyzing and Recording Transactions

Exam 1: Accounting in Business245 Questions

Exam 2: Analyzing and Recording Transactions201 Questions

Exam 3: Adjusting Accounts and Preparing Financial Statements227 Questions

Exam 4: Completing the Accounting Cycle177 Questions

Exam 5: Accounting for Merchandising Operations189 Questions

Exam 6: Inventories and Cost of Sales194 Questions

Exam 7: Accounting Information Systems166 Questions

Exam 8: Cash and Internal Controls195 Questions

Exam 9: Accounting for Receivables162 Questions

Exam 10: Long-Term Assets208 Questions

Exam 11: Current Liabilities and Payroll Accounting178 Questions

Exam 12: Accounting for Partnerships141 Questions

Exam 13: Accounting for Corporations210 Questions

Exam 14: Long-Term Liabilities158 Questions

Exam 15: Investments and International Operations156 Questions

Exam 16: Statement of Cash Flows173 Questions

Exam 17: Analysis of Financial Statements182 Questions

Exam 18: Managerial Accounting Concepts and Principles199 Questions

Exam 19: Job Order Cost Accounting165 Questions

Exam 20: Process Cost Accounting172 Questions

Exam 21: Cost Allocation and Performance Measurement173 Questions

Exam 22: Cost-Volume-Profit Analysis190 Questions

Exam 23: Master Budgets and Planning166 Questions

Exam 24: Flexible Budgets and Standard Costs178 Questions

Exam 25: Capital Budgeting and Managerial Decisions153 Questions

Select questions type

Posting is the transfer of journal entry information to the ledger.

(True/False)

4.8/5  (31)

(31)

An income statement reports the revenues earned less expenses incurred by a business over a period of time.

(True/False)

4.9/5  (33)

(33)

During the month of February, Hoffer Company had cash receipts of $7,500 and cash disbursements of $8,600. The February 28 cash balance was $1,800. What was the January 31 beginning cash balance?

(Multiple Choice)

4.8/5  (37)

(37)

____________________________ and _____________________ are the starting points for the analyzing and recording process.

(Essay)

4.9/5  (30)

(30)

The third step in the analyzing and recording process is to post the information to ________________________.

(Essay)

4.9/5  (25)

(25)

A record of the increases and decreases in a specific asset, liability, equity, revenue, or expense is a(n):

(Multiple Choice)

4.7/5  (29)

(29)

Items such as sales tickets, bank statements, checks, and purchase orders are source documents.

(True/False)

4.9/5  (35)

(35)

A company sends a $1,500 bill to a customer for delivery services rendered. Set up the necessary T-accounts below and show how this transaction would be recorded directly in those accounts.

(Essay)

4.8/5  (35)

(35)

A ___________________ is a record containing all accounts for a company along with their balances.

(Essay)

4.8/5  (30)

(30)

Explain how accounts are used in recording information about transactions.

(Essay)

4.9/5  (38)

(38)

The _______________________ is a record containing all accounts used by a company.

(Essay)

4.8/5  (38)

(38)

Dolly Barton began Barton Office Services in October and during that month completed these transactions:

a. Invested $10,000 cash, and $15,000 of computer equipment.

b. Paid $500 cash for an insurance premium covering the next 12 months.

c. Completed a word processing assignment for a customer and collected $1,000 cash.

d. Paid $200 cash for office supplies.

e. Paid $2,000 for October's rent.

Prepare journal entries to record the above transactions. Explanations are unnecessary.

(Essay)

4.9/5  (35)

(35)

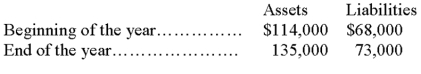

Josephine's Bakery had the following assets and liabilities at the beginning and end of the current year:

If Josephine invested an additional $12,000 in the business and withdrew $5,000 during the year, what was the amount of net income earned by Josephine's Bakery?

(Essay)

4.8/5  (38)

(38)

Inge Industries received $3,000 from a customer for services rendered and not previously recorded. Inge's general journal entry to record this transaction will be:

(Multiple Choice)

4.8/5  (36)

(36)

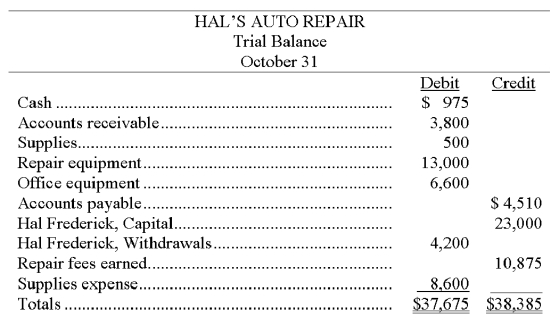

The following trial balance is prepared from the general ledger of Hal's Auto Repair.

Because the trial balance did not balance, you decided to examine the accounting records. You found that the following errors had been made:

1. A purchase of supplies on account for $245 was posted as a debit to Supplies and as a debit to Accounts Payable.

2. An investment of $500 cash by the owner was debited to Hal Frederick, Capital and credited to Cash.

3. In computing the balance of the Accounts Receivable account, a debit of $600 was omitted from the computation.

4. One debit of $300 to the Hal Frederick, Withdrawals account was posted as a credit.

5. Office equipment purchased for $800 was posted to the Repair Equipment account.

6. One entire entry was not posted to the general ledger. The transaction involved the receipt of $125 cash for repair services performed for cash.

Prepare a corrected trial balance for the Hal's Auto Repair as of October 31.

(Essay)

4.9/5  (37)

(37)

A column in journals and ledger accounts used to cross reference journal and ledger entries is the:

(Multiple Choice)

4.8/5  (37)

(37)

Of the following accounts, the one that normally has a credit balance is:

(Multiple Choice)

4.8/5  (33)

(33)

Showing 141 - 160 of 201

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)