Exam 8: Profit Maximization and Competitive Supply

Exam 1: Preliminaries78 Questions

Exam 2: The Basics of Supply and Demand139 Questions

Exam 3: Consumer Behavior134 Questions

Exam 4: Individual and Market Demand131 Questions

Exam 5: Uncertainty and Consumer Behavior150 Questions

Exam 6: Production125 Questions

Exam 7: The Cost of Production178 Questions

Exam 8: Profit Maximization and Competitive Supply164 Questions

Exam 9: The Analysis of Competitive Markets183 Questions

Exam 10: Market Power: Monopoly and Monopsony158 Questions

Exam 11: Pricing With Market Power130 Questions

Exam 12: Monopolistic Competition and Oligopoly120 Questions

Exam 13: Game Theory and Competitive Strategy150 Questions

Exam 14: Markets for Factor Inputs134 Questions

Exam 15: Investment, Time, and Capital Markets153 Questions

Exam 16: General Equilibrium and Economic Efficiency126 Questions

Exam 17: Markets With Asymmetric Information133 Questions

Exam 18: Externalities and Public Goods131 Questions

Exam 19: Behavioral Economics101 Questions

Select questions type

Which of the following is NOT a necessary condition for long-run equilibrium under perfect competition?

(Multiple Choice)

4.9/5  (40)

(40)

Following Example 8.8 in the book, the long-run supply of rental housing in most U.S. communities is more inelastic than the long-run supply of owner-occupied housing. Why?

(Multiple Choice)

4.8/5  (33)

(33)

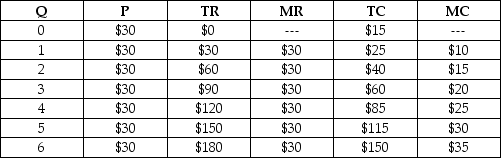

Table 8.1

-Refer to Table 8.1. The maximum profit available to the firm is:

-Refer to Table 8.1. The maximum profit available to the firm is:

(Multiple Choice)

4.8/5  (36)

(36)

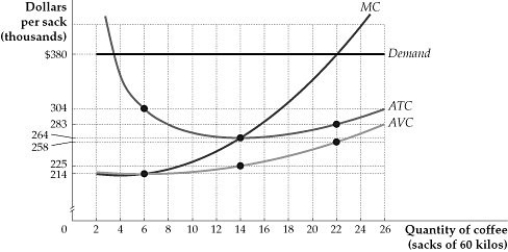

Figure 8.4.2

-Refer to Figure 8.4.2 above. When average variable cost (AVC) is minimum,

Figure 8.4.2

-Refer to Figure 8.4.2 above. When average variable cost (AVC) is minimum,

(Multiple Choice)

4.8/5  (38)

(38)

Use the following statements to answer this question: I. Under perfect competition, an upward shift in the marginal cost curve (perhaps due to a higher price for a variable input) also shifts the average variable cost curve upward.

II) Under perfect competition, an upward shift in the marginal cost curve (perhaps due to a higher price for a variable input) reduces firm output but may increase firm profits.

(Multiple Choice)

4.9/5  (39)

(39)

Suppose a technological innovation shifts the marginal cost curve downward. Which one of the following cost curves does NOT shift?

(Multiple Choice)

4.8/5  (37)

(37)

The demand curve and long-run supply curve for carpet cleaning in the local market are:

QD = 1,000 - 10P and QS = 640 + 2P.

The long-run cost function for a carpet cleaning business is:

C(q) = 3  .

The long-run marginal cost function is:

MC(q) = 6q.

If the carpet cleaning business is competitive, calculate the optimal output for each firm. How many firms are in the local market? Is the carpet cleaning industry an increasing, constant, or decreasing cost industry?

.

The long-run marginal cost function is:

MC(q) = 6q.

If the carpet cleaning business is competitive, calculate the optimal output for each firm. How many firms are in the local market? Is the carpet cleaning industry an increasing, constant, or decreasing cost industry?

(Essay)

4.9/5  (32)

(32)

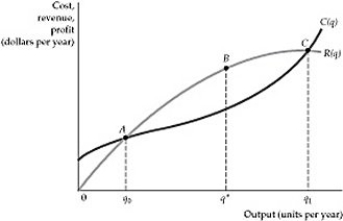

Figure 8.3.1

-Refer to Figure 8.3.1 above. At which point or range is profit maximized?

Figure 8.3.1

-Refer to Figure 8.3.1 above. At which point or range is profit maximized?

(Multiple Choice)

4.9/5  (29)

(29)

In the short run, a perfectly competitive firm earning negative economic profit:

(Multiple Choice)

4.8/5  (31)

(31)

An industry analyst observes that in response to a small increase in price, a competitive firm's output sometimes rises a little and sometimes a lot. The best explanation for this finding is that:

(Multiple Choice)

4.9/5  (34)

(34)

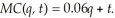

The long-run cost function for LeAnn's telecommunication firm is:  A local telecommunication tax of $0.01 has been implemented for each unit LeAnn sells. This implies the marginal cost function becomes:

A local telecommunication tax of $0.01 has been implemented for each unit LeAnn sells. This implies the marginal cost function becomes:  If LeAnn can sell all the units she produces at the market price of $0.70, calculate LeAnn's optimal output before and after the tax. What effect did the tax have on LeAnn's output level? How did LeAnn's profits change?

If LeAnn can sell all the units she produces at the market price of $0.70, calculate LeAnn's optimal output before and after the tax. What effect did the tax have on LeAnn's output level? How did LeAnn's profits change?

(Essay)

4.9/5  (37)

(37)

A competitive firm sells its product at a price of $0.10 per unit. Its total and marginal cost functions are:

TC = 5 - 0.5Q + 0.001Q2

MC = -0.5 + 0.002Q,

where TC is total cost ($) and Q is output rate (units per time period).

a. Determine the output rate that maximizes profit or minimizes losses in the short term.

b. If input prices increase and cause the cost functions to become

TC = 5 - 0.10Q + 0.002Q2

MC = -0.10 + 0.004Q,

what will the new equilibrium output rate be? Explain what happened to the profit maximizing output rate when input prices were increased.

(Essay)

4.8/5  (38)

(38)

Bud Owen operates Bud's Package Store in a small college town. Bud sells six packs of beer for off-premises consumption. Bud has very limited store space and has decided to limit his product line to one brand of beer, choosing to forego the snack food lines that normally accompany his business. Bud's is the only beer retailer physically located within the town limits. He faces considerable competition, however, from sellers located outside of town. Bud regards the market as highly competitive and considers the current $2.50 per six pack selling price to be beyond his control. Bud's total and marginal cost functions are:

TC = 2000 + 0.0005Q2

MC = 0.001Q,

where Q refers to six packs per week. Included in the fixed cost figure is a $750 per week salary for Bud, which he considers to be his opportunity cost.

a. Calculate the profit maximizing output for Bud. What is his profit? Is this an economic profit or an accounting profit?

b. The town council has voted to impose a tax of $.50 per six pack sold in the town, hoping to discourage beer consumption. What impact will the tax have on Bud? Should Bud continue to operate? What impact will the tax have on Bud's out-of-town competitors?

(Essay)

4.8/5  (36)

(36)

An industry has 1000 competitive firms, each producing 50 tons of output. At the current market price of $10, half of the firms have a short-run supply curve with a slope of 1; the other half each have a short-run supply curve with slope 2. The short-run elasticity of market supply is:

(Multiple Choice)

4.9/5  (38)

(38)

Suppose your firm operates in a perfectly competitive market and decides to double its output. How does this affect the firm's marginal profit?

(Multiple Choice)

5.0/5  (29)

(29)

Suppose a firm has unavoidable fixed costs of $500,000 per year, and it decides to shut down. What is the firm's producer surplus?

(Multiple Choice)

4.8/5  (33)

(33)

Although the long-run equilibrium price of oil is $80 per barrel, some producers have much lower costs because their oil reserves are relatively close to the surface and are easier to extract. If the low-cost producers have a minimum LAC equal to $20 per barrel, then the difference ($60 per barrel) is:

(Multiple Choice)

4.8/5  (27)

(27)

Showing 81 - 100 of 164

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)