Exam 8: Profit Maximization and Competitive Supply

Exam 1: Preliminaries78 Questions

Exam 2: The Basics of Supply and Demand139 Questions

Exam 3: Consumer Behavior134 Questions

Exam 4: Individual and Market Demand131 Questions

Exam 5: Uncertainty and Consumer Behavior150 Questions

Exam 6: Production125 Questions

Exam 7: The Cost of Production178 Questions

Exam 8: Profit Maximization and Competitive Supply164 Questions

Exam 9: The Analysis of Competitive Markets183 Questions

Exam 10: Market Power: Monopoly and Monopsony158 Questions

Exam 11: Pricing With Market Power130 Questions

Exam 12: Monopolistic Competition and Oligopoly120 Questions

Exam 13: Game Theory and Competitive Strategy150 Questions

Exam 14: Markets for Factor Inputs134 Questions

Exam 15: Investment, Time, and Capital Markets153 Questions

Exam 16: General Equilibrium and Economic Efficiency126 Questions

Exam 17: Markets With Asymmetric Information133 Questions

Exam 18: Externalities and Public Goods131 Questions

Exam 19: Behavioral Economics101 Questions

Select questions type

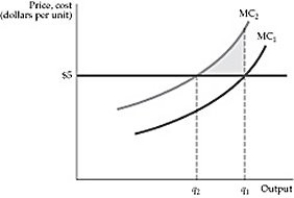

Figure 8.5.2

-Refer to Figure 8.5.2 above. The shift in the marginal cost curve implies:

Figure 8.5.2

-Refer to Figure 8.5.2 above. The shift in the marginal cost curve implies:

(Multiple Choice)

4.9/5  (35)

(35)

In the long-run equilibrium of a competitive market, the market supply and demand are:

Supply: P = 30 + 0.50Q

Demand: P = 100 - 1.5Q,

where P is dollars per unit and Q is rate of production and sales in hundreds of units per day. A typical firm in this market has a marginal cost of production expressed as:

MC = 3.0 + 15q.

a. Determine the market equilibrium rate of sales and price.

b. Determine the rate of sales by the typical firm.

c. Determine the economic rent that the typical firm enjoys. (Hint: Note that the marginal cost function is linear.)

d. If an output tax is imposed on ONE firm's output such that the ONE firm has a new marginal cost (including the tax) of:  what will the firm's new rate of production be after the tax is imposed? How does this new production rate compare with the pre-tax rate? Is it as expected? Explain. Would the effect have been the same if the tax had been imposed on all firms equally? Explain.

what will the firm's new rate of production be after the tax is imposed? How does this new production rate compare with the pre-tax rate? Is it as expected? Explain. Would the effect have been the same if the tax had been imposed on all firms equally? Explain.

(Essay)

4.9/5  (29)

(29)

If price is between AVC and ATC, the best and most practical thing for a perfectly competitive firm to do is:

(Multiple Choice)

4.9/5  (37)

(37)

In long-run competitive equilibrium, a firm that owns factors of production will have an:

(Multiple Choice)

4.7/5  (40)

(40)

Showing 161 - 164 of 164

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)