Exam 6: Decision Making Under Uncertainty

Exam 1: Introduction to Business Analytics29 Questions

Exam 2: Describing the Distribution of a Single Variable100 Questions

Exam 3: Finding Relationships Among Variables85 Questions

Exam 4: Probability and Probability Distributions114 Questions

Exam 5: Normal, Binomial, Poisson, and Exponential Distributions125 Questions

Exam 6: Decision Making Under Uncertainty107 Questions

Exam 7: Sampling and Sampling Distributions90 Questions

Exam 8: Confidence Interval Estimation84 Questions

Exam 9: Hypothesis Testing87 Questions

Exam 10: Regression Analysis: Estimating Relationships92 Questions

Exam 11: Regression Analysis: Statistical Inference82 Questions

Exam 12: Time Series Analysis and Forecasting106 Questions

Exam 13: Introduction to Optimization Modeling97 Questions

Exam 14: Optimization Models114 Questions

Exam 15: Introduction to Simulation Modeling82 Questions

Exam 16: Simulation Models102 Questions

Exam 17: Data Mining20 Questions

Exam 18: Importing Data Into Excel19 Questions

Exam 19: Analysis of Variance and Experimental Design20 Questions

Exam 20: Statistical Process Control20 Questions

Select questions type

A risk profile lists the full probability distribution.

Free

(True/False)

4.7/5  (35)

(35)

Correct Answer:

True

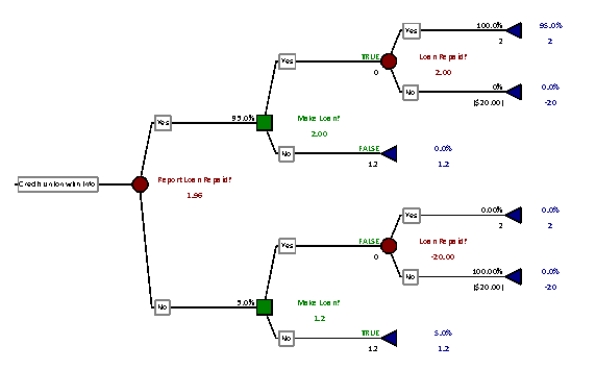

The bank can thoroughly investigate the customer's credit record and obtain a favorable or unfavorable recommendation. If the credit report is perfectly reliable, what is the most the credit union should be willing to pay for the report?

Free

(Essay)

4.9/5  (41)

(41)

Correct Answer:

The tree above shows that if the credit report is favorable, the credit union should make the loan, and if the report is unfavorable, it should not make the loan. This increases the expected value to $1,960 with the credit information. Thus, the EVPI is $760, which is the most the credit union should be willing to pay.

The tree above shows that if the credit report is favorable, the credit union should make the loan, and if the report is unfavorable, it should not make the loan. This increases the expected value to $1,960 with the credit information. Thus, the EVPI is $760, which is the most the credit union should be willing to pay.

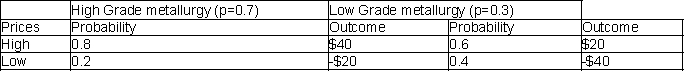

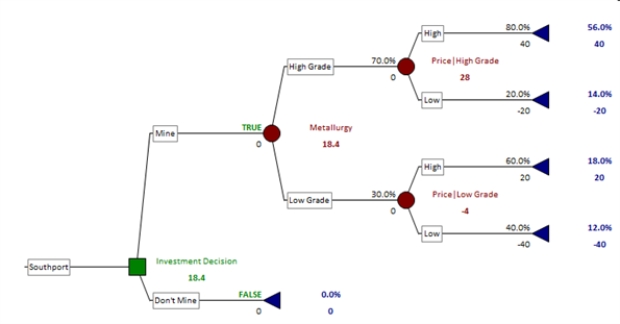

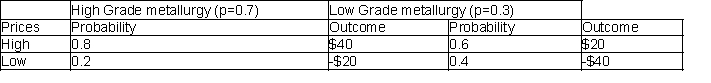

Southport Mining Corporation is considering a new mining venture in Indonesia. There are two uncertainties associated with this prospect; the metallurgical properties of the ore and the net price (market price minus mining and transportation costs) of the ore in the future.

The metallurgical properties of the ore would be classified as either "high grade" or "low grade". Southport's geologists have estimated that there is a 70% chance that the ore will be "high grade", and otherwise, it will be "low grade". Depending on the net price, both ore classifications could be commercially successful.

The anticipated net prices depended on market conditions, and also on the metallurgical properties of the ore. Southport's economists have simplified the continuous distribution of possible prices into a two-outcome discrete distribution ("high" or "low" net price) for the investment analysis. The probabilities of these net prices, and the associated outcomes (in millions of dollars), are summarized below.  -Construct a decision tree to help Southport identify the strategy that maximizes its expected profit for this investment. Make sure to label all decision and chance nodes and include appropriate costs, payoffs and probabilities.

-Construct a decision tree to help Southport identify the strategy that maximizes its expected profit for this investment. Make sure to label all decision and chance nodes and include appropriate costs, payoffs and probabilities.

Free

(Essay)

4.9/5  (44)

(44)

Correct Answer:

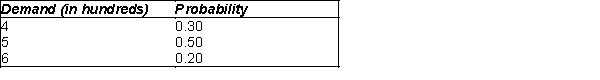

A buyer for a large sporting goods store chain must place orders for professional footballs with the football manufacturer six months prior to the time the footballs will be sold in the stores. The buyer must decide in November how many footballs to order for sale during the upcoming late summer and fall months. Assume that each football costs the chain $45. Furthermore, assume that each pair can be sold for a retail price of $90. If the footballs are still on the shelves after next Christmas, they can be discounted and sold for $35 each. The probability distribution of consumer demand for these footballs (in hundreds) during the upcoming season has been assessed by the market research specialists and is presented below. Finally, assume that the sporting goods store chain must purchase the footballs in lots of 100 units.  -What is the optimal strategy for order quantity, and what is the expected profit in that case?

-What is the optimal strategy for order quantity, and what is the expected profit in that case?

(Essay)

4.7/5  (31)

(31)

A strategy region chart is useful for seeing whether the decision changes over the range of the input variable.

(True/False)

5.0/5  (41)

(41)

Exponential utility has an adjustable parameter called risk tolerance. The risk tolerance parameter measures:

(Multiple Choice)

4.7/5  (33)

(33)

Rational decision makers are never willing to violate the expected monetary value (EMV) maximization criterion when large amounts of money are at stake.

(True/False)

4.8/5  (41)

(41)

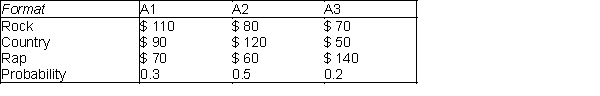

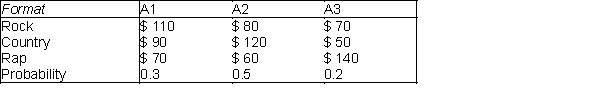

The owner of a radio station in a rapidly growing community in central Texas is about to begin operations and must decide what type of program format to offer. She is considering three formats; rock, country, and rap. The number of listeners for a particular format will depend on the type of potential audience that is available. Income from advertising depends on the number of listeners the station has. Three broad categories of audience type can be described as A1, A2, and A3. The rock music format draws mainly for the A1 listener, the country music format draws mainly from the A2 listener and the rap music format draws mainly from the A3 listener. The station owner does not know which type of audience will dominate the community once its growth has stabilized. Probabilities have been assigned to the potential dominant audience, based on the community growth that has already occurred in this area. Since she wants to begin building an image now, the decision as to which format to adopt must be made in an environment of uncertainty. The station owner has been able to construct the following payoff table, in which the entries are average monthly revenue in thousands of dollars.

Audience  -What format is optimal? What is the expected profit in that case?

-What format is optimal? What is the expected profit in that case?

(Essay)

4.9/5  (37)

(37)

The network can conduct market research to determine whether a program will be a hit or a flop. If the market research report is perfectly reliable, what is the most the network should be willing to pay for it?

(Essay)

4.8/5  (30)

(30)

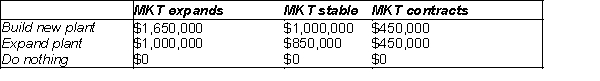

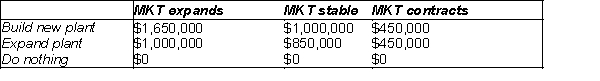

The Waco Tire Company (WTC) is considering expanding production to meet possible increases in demand. WTC's alternatives are to construct a new plant, expand the existing plant, or do nothing in the short run. It will cost them $1 million to build a new facility and $600,000 to expand their existing facility. The market for this particular product may expand, remain stable, or contract. ETC's marketing department estimates the probabilities of these market outcomes as 0.30, 0.45, and 0.25, respectively. The expected revenue for each alternative is presented in the table below.  -(A) What is WTC's payoff if they build a new plant and the market expands?

(B) What is WTC's payoff if they build a new plant and the market is stable?

(C) What is WTC's payoff if they build a new plant and the market contracts?

(D) What is WTC's payoff if they expand the plant and the market expands?

(E) What is WTC's payoff if they expand the plant and the market is stable?

(F) What is WTC's payoff if they expand the plant and the market contracts?

(G) What is WTC's payoff if they do nothing and the market expands?

(H) What is WTC's payoff if they do nothing and the market is stable?

(I) What is WTC's payoff if they do nothing and the market contracts?

-(A) What is WTC's payoff if they build a new plant and the market expands?

(B) What is WTC's payoff if they build a new plant and the market is stable?

(C) What is WTC's payoff if they build a new plant and the market contracts?

(D) What is WTC's payoff if they expand the plant and the market expands?

(E) What is WTC's payoff if they expand the plant and the market is stable?

(F) What is WTC's payoff if they expand the plant and the market contracts?

(G) What is WTC's payoff if they do nothing and the market expands?

(H) What is WTC's payoff if they do nothing and the market is stable?

(I) What is WTC's payoff if they do nothing and the market contracts?

(Short Answer)

4.8/5  (37)

(37)

The Waco Tire Company (WTC) is considering expanding production to meet possible increases in demand. WTC's alternatives are to construct a new plant, expand the existing plant, or do nothing in the short run. It will cost them $1 million to build a new facility and $600,000 to expand their existing facility. The market for this particular product may expand, remain stable, or contract. ETC's marketing department estimates the probabilities of these market outcomes as 0.30, 0.45, and 0.25, respectively. The expected revenue for each alternative is presented in the table below.  -Construct a decision tree to identify the course of action that maximizes WTC's expected profit. Make sure to label all decision and chance nodes and include appropriate costs, payoffs and probabilities.

-Construct a decision tree to identify the course of action that maximizes WTC's expected profit. Make sure to label all decision and chance nodes and include appropriate costs, payoffs and probabilities.

(Short Answer)

4.9/5  (24)

(24)

In the nomenclature of Bayes' Rule, which of the following are probabilities that are conditioned on information that is obtained?

(Multiple Choice)

4.9/5  (37)

(37)

If x is a monetary value (a payoff if positive, a cost if negative), U(x) the utility of this value, and R > 0 is the risk tolerance, then the function U(x) = 1 -  is called a(n):

is called a(n):

(Multiple Choice)

4.8/5  (30)

(30)

The owner of a radio station in a rapidly growing community in central Texas is about to begin operations and must decide what type of program format to offer. She is considering three formats; rock, country, and rap. The number of listeners for a particular format will depend on the type of potential audience that is available. Income from advertising depends on the number of listeners the station has. Three broad categories of audience type can be described as A1, A2, and A3. The rock music format draws mainly for the A1 listener, the country music format draws mainly from the A2 listener and the rap music format draws mainly from the A3 listener. The station owner does not know which type of audience will dominate the community once its growth has stabilized. Probabilities have been assigned to the potential dominant audience, based on the community growth that has already occurred in this area. Since she wants to begin building an image now, the decision as to which format to adopt must be made in an environment of uncertainty. The station owner has been able to construct the following payoff table, in which the entries are average monthly revenue in thousands of dollars.

Audience  -As the average monthly revenue associated with the rock format and an A1 audience varies between $85,000 to about $140,000, what happens to the maximum expected revenue? Briefly explain why.

-As the average monthly revenue associated with the rock format and an A1 audience varies between $85,000 to about $140,000, what happens to the maximum expected revenue? Briefly explain why.

(Essay)

4.7/5  (26)

(26)

The expected value of perfect information (EVPI) is the most the decision maker would be willing to pay for the sample information.

(True/False)

4.8/5  (34)

(34)

Perform a sensitivity analysis on the optimal decision and summarize your findings. Vary the probability of being in an accident from 0% to 10%, the insurance premium from $50 to $300, and the deductible amount from $0 to $600. In response to which model inputs is the expected total cost value most sensitive?

(Essay)

4.7/5  (33)

(33)

In decision trees, an end node (a triangle) indicates that the problem is completed; that is, all decisions have been made, all uncertainty has been resolved, and all payoffs/costs have been incurred.

(True/False)

4.9/5  (34)

(34)

Southport Mining Corporation is considering a new mining venture in Indonesia. There are two uncertainties associated with this prospect; the metallurgical properties of the ore and the net price (market price minus mining and transportation costs) of the ore in the future.

The metallurgical properties of the ore would be classified as either "high grade" or "low grade". Southport's geologists have estimated that there is a 70% chance that the ore will be "high grade", and otherwise, it will be "low grade". Depending on the net price, both ore classifications could be commercially successful.

The anticipated net prices depended on market conditions, and also on the metallurgical properties of the ore. Southport's economists have simplified the continuous distribution of possible prices into a two-outcome discrete distribution ("high" or "low" net price) for the investment analysis. The probabilities of these net prices, and the associated outcomes (in millions of dollars), are summarized below.  -Should Southport conduct the imperfect core test if it costs $250,000?

-Should Southport conduct the imperfect core test if it costs $250,000?

(Essay)

4.9/5  (37)

(37)

Showing 1 - 20 of 107

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)