Exam 16: Analyzing and Forecasting Time-Series Data

Exam 1: The Where, Why, and How of Data Collection167 Questions

Exam 2: Graphs, Charts and Tablesdescribing Your Data138 Questions

Exam 3: Describing Data Using Numerical Measures138 Questions

Exam 4: Introduction to Probability125 Questions

Exam 5: Discrete Probability Distributions161 Questions

Exam 6: Introduction to Continuous Probability Distributions122 Questions

Exam 7: Introduction to Sampling Distributions136 Questions

Exam 8: Estimating Single Population Parameters174 Questions

Exam 9: Introduction to Hypothesis Testing183 Questions

Exam 10: Estimation and Hypothesis Testing for Two Population Parameters121 Questions

Exam 11: Hypothesis Tests and Estimation for Population Variances69 Questions

Exam 12: Analysis of Variance162 Questions

Exam 13: Goodness-Of-Fit Tests and Contingency Analysis105 Questions

Exam 14: Introduction to Linear Regression and Correlation Analysis139 Questions

Exam 15: Multiple Regression Analysis and Model Building148 Questions

Exam 16: Analyzing and Forecasting Time-Series Data131 Questions

Exam 17: Introduction to Nonparametric Statistics103 Questions

Exam 18: Introducing Business Analytics48 Questions

Exam 19: Introduction to Decision Analysis48 Questions

Exam 20: Introduction to Quality and Statistical Process Control42 Questions

Select questions type

Harrison Hollow, an upscale eatery in Atlanta, tracks its sales on a daily basis. Recently, the manager stated that sales over the past three weeks have been very cyclical. Given the data she has, this statement is not a reasonable one to make.

(True/False)

4.8/5  (39)

(39)

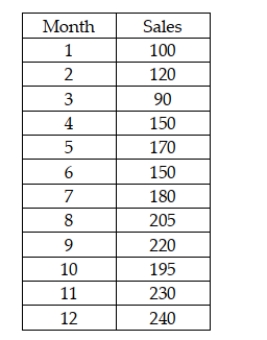

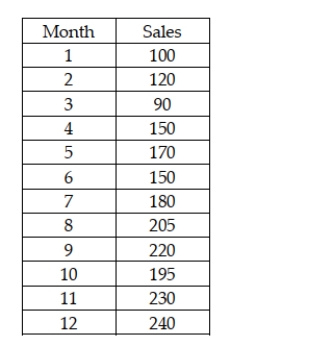

The Morgan Company is interested in developing a forecast for next month's sales. It has collected sales data for the past 12 months.  After analyzing these data, if the company wishes to use double exponential smoothing with alpha = 0.20 and beta = 0.20, the starting values for the constant process and the trend process can be derived from a linear trend regression model by using the intercept and slope coefficient respectively.

After analyzing these data, if the company wishes to use double exponential smoothing with alpha = 0.20 and beta = 0.20, the starting values for the constant process and the trend process can be derived from a linear trend regression model by using the intercept and slope coefficient respectively.

(True/False)

4.9/5  (39)

(39)

If the Durbin-Watson d statistic has a value close to 2, there is reason to believe that there is no autocorrelation between the forecast errors.

(True/False)

4.8/5  (32)

(32)

If a forecast period is one month, then we will provide a new forecast each month.

(True/False)

4.9/5  (31)

(31)

If a time series contains substantial irregular movement, the smoothing constant for a single exponential smoothing model that is close to 1.0 will result in forecasts that are not as smoothed out as those that would occur if a smaller smoothing constant was used.

(True/False)

4.8/5  (31)

(31)

From an annual time series of a company's employee income, the linear trend model Ft = 165 - 54(t) has been developed. This means that on average income has been increasing by 165 per year.

(True/False)

4.8/5  (35)

(35)

In using simple linear regression to find the linear trend in an annual time series from 2000 to 2015, the values 2000, 2001, etc. are used as the values of the independent variable t when the regression is conducted.

(True/False)

4.9/5  (41)

(41)

If the forecast errors are autocorrelated, this is a good indication that the model has been specified correctly.

(True/False)

4.8/5  (36)

(36)

The forecasting interval is the unit of time for which forecasts are made.

(True/False)

4.8/5  (35)

(35)

You are given the following linear trend model: Ft = 345.60 - 200.5(t). The forecast for period 15 is approximately -2,662.

(True/False)

4.8/5  (36)

(36)

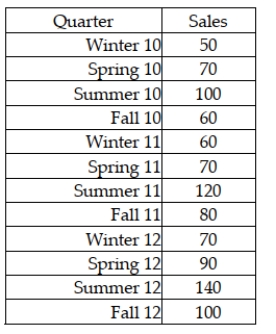

The Boxer Company has been in business since 1998. The following sales data are recorded by quarter for the years 2010-2012.  The managers at the company wish to determine the seasonal indexes for each quarter during the year. The first step in the process is to remove the seasonal and random components. To do this, they will begin by computing a four-period moving average. They then compute the centered moving average. What is the centered moving average for Spring '01?

The managers at the company wish to determine the seasonal indexes for each quarter during the year. The first step in the process is to remove the seasonal and random components. To do this, they will begin by computing a four-period moving average. They then compute the centered moving average. What is the centered moving average for Spring '01?

(Multiple Choice)

5.0/5  (38)

(38)

Double exponential smoothing is used instead of single exponential smoothing when extra smooth forecasts are desired.

(True/False)

4.8/5  (35)

(35)

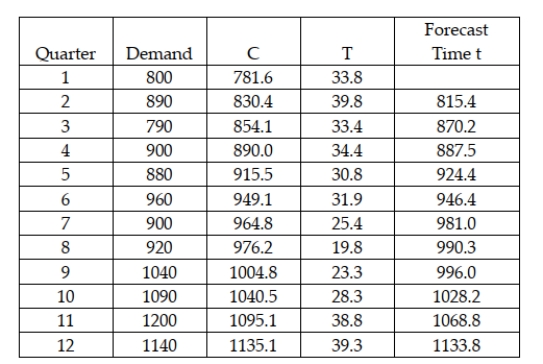

The Wilson Company is interested in forecasting demand for its XG-667 product for quarter 13 based on 12 quarters of data. The following shows the data and the double exponential smoothing model results for periods 1-12 using alpha = 0.20 and beta = 0.40  Based on this information, what is the difference between the forecast for period 13 using smoothing constants of alpha = 0.20 and beta = 0.40 and smoothing constants of alpha = 0.10 and beta = 0.30? (Assume that the starting values for period 0 are C = 745 and T = 32.)

Based on this information, what is the difference between the forecast for period 13 using smoothing constants of alpha = 0.20 and beta = 0.40 and smoothing constants of alpha = 0.10 and beta = 0.30? (Assume that the starting values for period 0 are C = 745 and T = 32.)

(Multiple Choice)

4.8/5  (36)

(36)

In a recent meeting, the marketing manager for a large hardware company stated that he needed to have a forecast prepared for the next three months. The three-month period is called:

(Multiple Choice)

4.9/5  (34)

(34)

Model specification is the process of determining how well a forecasting model fits the past data.

(True/False)

4.9/5  (43)

(43)

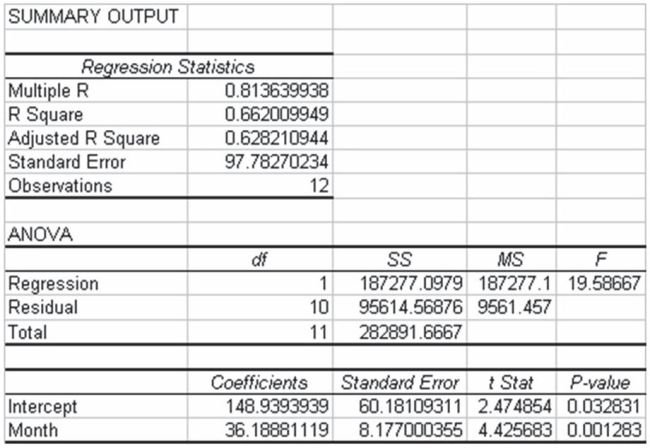

The following output is provided for a linear trend regression-based forecasting model based on 12 months of data:  Suppose that the actual sales for months 13-15 are: 720, 680, 800. Given this, which of the following is the forecast bias value for months 13-15?

Suppose that the actual sales for months 13-15 are: 720, 680, 800. Given this, which of the following is the forecast bias value for months 13-15?

(Multiple Choice)

4.8/5  (39)

(39)

The Morgan Company is interested in developing a forecast for next month's sales. It has collected sales data for the past 12 months.  After analyzing these data, if the company wishes to use exponential smoothing, it should employ a single smoothing model since there is evidence of a linear trend in the data.

After analyzing these data, if the company wishes to use exponential smoothing, it should employ a single smoothing model since there is evidence of a linear trend in the data.

(True/False)

4.8/5  (31)

(31)

Which of the following is true about index numbers? Index numbers are:

(Multiple Choice)

4.7/5  (25)

(25)

A time-series graph shows that monthly income data have decreased gradually over the past 5 years. Given this, if a linear trend model is used to forecast future monthly income, the sign on the regression slope coefficient will be negative.

(True/False)

4.8/5  (26)

(26)

Showing 21 - 40 of 131

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)